CardAvantaj VIRTUAL but with advantages as real as possible

In addition to the benefits of a physical card, the virtual card comes with extra security benefits.

Exchange

| Symbol | BNR | Buy | Sell |

|---|---|---|---|

| EUR | 4,9775 | 4,9100 | 5,0200 |

| USD | 4,3576 | 4,3300 | 4,4500 |

| GBP | 5,8057 | 5,7400 | 5,9000 |

| CHF | 5,2994 | 5,2300 | 5,3500 |

| SEK | 0,4555 | 0,4200 | 0,4740 |

| 100 JPY | 3,0702 | 3,0100 | 3,1700 |

* Current account exchange rates

Find out more| Natural person | 1 month* | 3 months |

|---|---|---|

| EUR | 0,60% | 1,00% |

| RON | 5,75% | 6,75% |

| Index | Last update | Rate |

|---|---|---|

| EURIBOR 12 LUNI | 23.04.2025 | 2.12800% |

| EURIBOR 6 LUNI | 23.04.2025 | 2.17300% |

| IRCC | 01.04.2025 | 5.55000% |

| ROBOR 3 LUNI | 23.04.2025 | 5.90000% |

| ROBOR 6 LUNI | 23.04.2025 | 5.99000% |

| SARON 1MC+M1 | 23.04.2025 | 0.14100% |

| SARON 3MC+M3 | 23.04.2025 | 0.35480% |

| SARON 3MC+M6 | 23.04.2025 | 0.42580% |

Virtual card, real benefits.

It is unlikely that you will be a victim of fraud, the virtual card cannot be stolen, and the card data can only be accessed by you in the AVANTAJ2go application.

Anonymized payments

Nowadays, more and more people are concerned about the safety of their personal data online. The virtual card is perfect for those who do not want to provide information about cards issued in physical format.

The perfect alternative of the main card

If you encounter difficulties in using the main card issued in physical format (loss, theft, demagnetization), you can use the virtual card until you receive the reissued physical card, so you still have access to your credit limit.

Install the application AVANTAJ2go and enjoy the benefits of CardAvantaj Virtual.

Registering the CardAvantaj Mastercard Virtual card in electronic payment applications

Similar to physical CardAvantaj Mastercard cards, also the virtual CardAvantaj Mastercard cards can be easily enrolled in any of the electronic payment applications Apple Pay or Google Pay.

Follow a few simple steps and enjoy secure payments through CardAvantaj Virtual

Let's say you forgot your wallet at home. It happens. It's ok, don't worry, you don't have to go back because you can issue your Virtual CardAvantaj directly from your phone. It's very simple, no trips to the bank, you save time and you can use the card immediately.

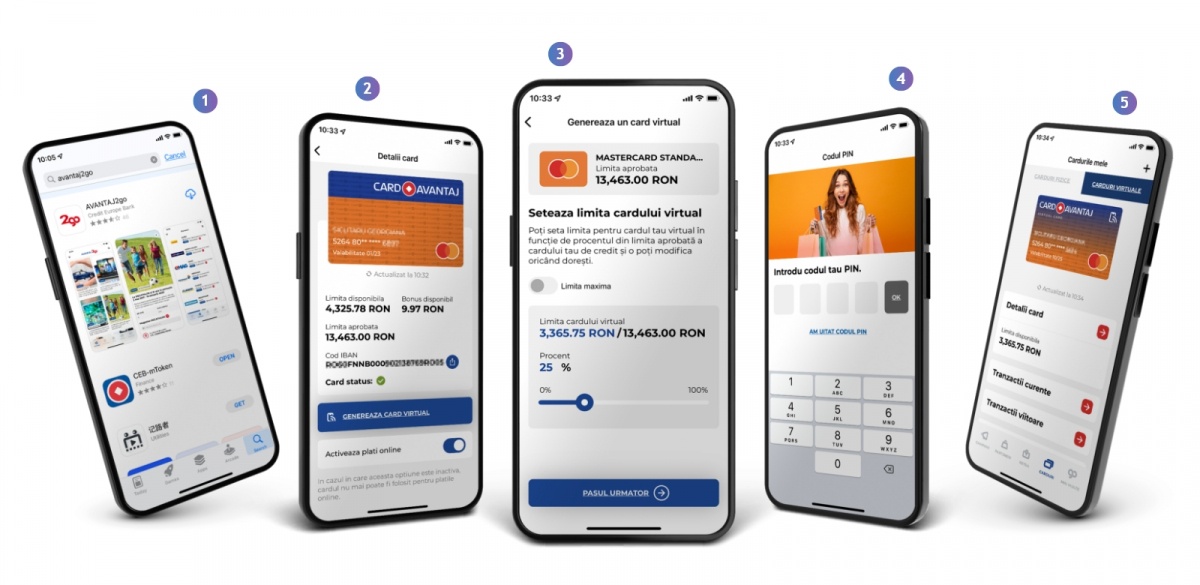

Issue yourself a virtual card by following the steps below:

- Install the AVANTAJ2go app for free from the App Store or Google Play.

- Go to the CARDS menu and choose to generate a Virtual CardAvantaj in the Card Details section.

- Set the limit percentage you want to allocate to the virtual card.

- Accept the "Terms and conditions" and authorize its issuance by entering the application's PIN code or biometric data.

- You can view the details of your new virtual card in the Virtual Cards tab.

* Pentru moment, doar cardurile virtuale și / sau fizice CardAvantaj Mastercard pot fi înrolate în aplicațiile electronice de plată de tipul Apple Pay sau Google Pay.

Watch the video tutorial on how to issue a virtual card on CardAvantaj's YouTube channel!

Video TutorialFrequently asked questions about virtual cards

-

Who can benefit from Credit Europe Bank N.V. Amsterdam Sucursala București's virtual cards?

Virtual cards are available for Credit Europe Bank customers who hold a credit card. If you don't have a CardAvantaj credit card, apply now!

-

How can an existing customer apply for a virtual credit card?

Virtual credit cards can be issued instantly from the AVANTAJ2go application. You must log in to the application using the set PIN or biometric data, access the option to issue the virtual card, read and accept the terms and conditions of issuance. For details on the broadcast stream you can refer here to the video tutorial.

-

What types of virtual credit cards are there?

At the moment, virtual credit cards can be issued for: CardAvantaj Mastercard Standard; CardAvantaj Mastercard Gold; CardAvantaj Mastercard Platinum; CardAvantaj VISA Classic; CardAvantaj VISA Gold; CardAvantaj VISA Platinum; Optimo Card Mastercard; CEB Diamond Card Gold; CEB Diamond Card Platinum.

-

How much does the virtual card cost?

Issuing a virtual card is free. The complete list of commissions and interest charged by the bank for the use of credit cards can be consulted in any territorial unit of the bank and on www.crediteurope.ro, section Individuals.

-

Can I have more than one virtual card?

No, you cannot issue several virtual cards for the same physical credit card (eg: CardAvantaj Mastercard Standard).

-

Which accounts can I attach a virtual card to?

For the moment, virtual cards can only be attached to credit cards offered by Credit Europe Bank N.V. Amsterdam Sucursala București.

-

How long after the physical card is issued can I attach a virtual card?

Virtual credit cards can be issued instantly, as soon as the physical card issuance process has been completed and the credit limit has been set.

-

Can I withdraw cash with a virtual card?

You cannot make cash withdrawals with a virtual card. It can be used by enrolling in an electronic payment application that will later allow contactless payments to be made at merchants, or for transactions on the Internet, on the websites and applications of merchants that accept payment by electronic wallet.

-

Where can I find all the details about the virtual card?

All the details about this new product are available on our website, in the "Virtual CardAvantaj" section.

-

From which account will my virtual card transactions be settled?

Transactions will be settled from the primary credit card account you select when you request the issuance of the virtual card.

-

What is the validity of the virtual card?

The validity of the virtual card is 3 years from the date of issue.

-

What is the order in which virtual cards are displayed in the mobile app?

Cards are displayed in the order they were issued. To find out more details about the transactions made with a certain card, select the card in the AVANTAJ2go application.

-

What can I do if I want to cancel the virtual card?

You can contact us by calling the CEBLine service (available 24h/24h) at phone numbers 0750.000.000 / 0724.100.000 (callable at normal rate from any network, including international) or in any Credit Europe Bank N.V. Amsterdam București's territorial unit.

-

How can I block/unblock a virtual card?

You can contact us by calling the CEBLine service (available 24h/24h) at phone numbers 0750.000.000 / 0724.100.000 (callable at normal rate from any network, including international) or in any Credit Europe Bank N.V. Amsterdam Unitatea teritorială București territorial unit.

-

How can I manage the limit allocated to the initial virtual card?

Management of virtual card limits can be done directly from the AVANTAJ2go application, accessing the "Card details" section.

-

Can I copy virtual card data for online transactions?

Of course! To copy the card data for online transactions, you must access "Card details". The action will be authorized using the PIN code set to access the AVANTAJ2go application. After accessing the "Card details" section, select the "Copy card number" option.

-

If I close or delete the Avantaj2GO application, will the virtual card be closed automatically?

Not. To close the virtual credit card, you must call the CEBLine service (available 24h/24h) at phone numbers 0750.000.000 / 0724.100.000 (callable at normal rate from any network, including international).

-

When the card expires do I have to renew it or does it renew automatically?

Virtual Cards are not automatically renewed.

-

What do I do if I can't find the virtual card in the AVANTAJ2go application?

If the newly issued virtual card does not appear in the AVANTAJ2go application or the displayed information is incorrect, please contact CEBLine customer service at phone numbers 0750.000.000 / 0724.100.000 (callable at normal rates from any network, including international).