Skip the lines and apply 100% ONLINE in just 15 MINUTES.

Apply for your CardAvantaj!

Actualizează-ți datele personale

Simplu și în siguranță, fără niciun drum la bancă. Durează aproximativ 10 minute!

Nurture your money in the easiest way possible: with monet, the new mobile banking application from Credit Europe Bank

From now on, the way you manage your money has received a safer, more intuitive and more efficient upgrade!

Recommend and win: 200 lei for each friend!

Convince your friends to apply for CardAvantaj and you can receive 200 lei BONUS * for each card issued from your recommendation. The more recommendations you make, the bigger bonus you can earn

Up to 12 installments through CEB Diamond!

Apply for the CEB Diamond card and have up to 12 INTEREST-FREE INSTALLMENTS anywhere in the world until November 30, 2024!

CardAvantaj VIRTUAL but with advantages as real as possible

In addition to the benefits of a physical card, the virtual card comes with extra security benefits.

Download the AVANTAJ2go app and you have total control over your card.

With AVANTAJ2go, you can always check the available balance, transactions made, payment amounts and CardAvantaj merchant partners promotions.

Enroll your card in Google Pay and pay with your phone!

Google Pay is a quick and easy way to make payments in millions of locations: in stores, online, or in apps. It gives you everything you need to make transactions convenient and secure.

Enroll your card in Apple Pay and pay with your phone!

Now you can leave your wallet at home! With Apple Pay, you have your Credit Europe Bank Mastercard card de wherever you take your phone. We mean anywhere. You pay safely, quickly and easily!

Avantaj SoftPOS turns any Android smartphone into a POS terminal

Through Avantaj SoftPOS app you can accept payments with your bank card directly on your mobile phone.

Credit cards

Credit Europe Bank products are the main reasons why over 400,000 Romanians have chosen to be our customers. Discover the complete offer of our cards.

CardAvantaj

CardAvantaj manages to turn every ordinary moment into a unique experience. Every day.

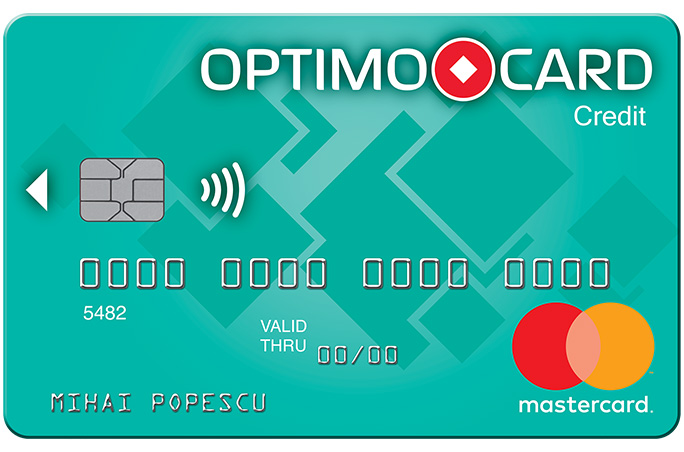

Optimo Card

Now you can buy everything you dreamed of because it's much easier to pay high value purchase in an extended time frame.

CEB Diamond

A world of exquisite shopping awaits you.

Wouldn't it be useful to always have CardAdvantaj with you?!

Apply nowDebit cards

Credit Europe Bank products are the main reasons why over 400,000 Romanians have chosen to be our customers. Discover the complete offer of our cards.

Mastercard Standard

Apply for Mastercard debit contactless card in any of Credit Europe Bank branches and benefit from a great offer!

Visa Clasic

Visa Clasic Debit from Credit Europe Bank is a multifunctional debit card in lei or in euro, for individuals.

Salary card

Get your salary on the VISA Classic Debit and Mastercard Standard Debit Card and enjoy the benefits!

Wouldn't it be useful to always have CardAdvantaj with you?!

Apply nowCredits

Seeking financing for your much desired project? Credit Europe Bank helps you put your plans into practice.

Deposits

When you have a sum of money, you think about where it is best to keep it. If you keep your money at home, you will not get interest, nor will it be completely safe.

Transactions and transfers

Through Credit Europe Bank, your money can safely reach the instant recipient. It is the fastest, safest and most efficient way to transfer cash.

Campaigns and information

Read the useful information provided by Credit Europe Bank to all its clients and do not miss the latest campaigns.

- Suspension of credit installments in the context of GEO 90/2022

- Pay fast and easy with the AVANTAJ2go contactless sticker

- Pay in an instant with the AVANTAJ2go contactless bracelet!

- With the ACASĂ loan you are closer than you think to your dream house

- Interest rates on deposits up to 2.25% per year

- Your salary comes with something extra

Exchange

| Symbol | BNR | Buy | Sell |

|---|---|---|---|

| EUR | 4,9766 | 4,9000 | 5,0500 |

| USD | 4,5865 | 4,5300 | 4,6800 |

| GBP | 5,9493 | 5,8500 | 6,0300 |

| CHF | 5,2076 | 5,1500 | 5,2700 |

| SEK | 0,4544 | 0,4230 | 0,4770 |

| 100 JPY | 3,0664 | 3,0000 | 3,1600 |

* Current account exchange rates

Find out more| Natural person | 1 month* | 3 months |

|---|---|---|

| EUR | 0,60% | 1,00% |

| RON | 5,75% | 6,75% |

| Index | Last update | Rate |

|---|---|---|

| EURIBOR 12 LUNI | 25.03.2025 | 2.36600% |

| EURIBOR 6 LUNI | 25.03.2025 | 2.39900% |

| IRCC | 01.01.2025 | 5.66000% |

| ROBOR 3 LUNI | 25.03.2025 | 5.91000% |

| ROBOR 6 LUNI | 25.03.2025 | 5.98000% |

| SARON 1MC+M1 | 25.03.2025 | 0.34860% |

| SARON 3MC+M3 | 25.03.2025 | 0.43390% |

| SARON 3MC+M6 | 25.03.2025 | 0.50490% |

Corporate

We know how important your business is. Whether you are on the go or you want to strengthen your market position, Credit Europe Bank will help you. We have created a wide range of competitive and personalized products to choose from. Thus, you can fully enjoy the comfort of a successful business.